A 1031 like kind exchange for real estate is a provision in the IRS tax code that allows a person or entity to defer paying tax on any gain from the sale of real estate. Here’s how it works in a nutshell:

Say you own a commercial property or rental home and want to sell. If your sale price is substantially higher than what you paid for the home you may end up owing the IRS taxes on the gain in value, after the sale. However, section 1031 of the IRS Code allows you to “defer” paying this tax IF you use those funds to purchase another “like kind” commercial/investment property. Here’s the caveat: you cannot actually take possession of the sale funds. They must be held by an escrow agent the IRS refers to as a “qualified intermediary.”

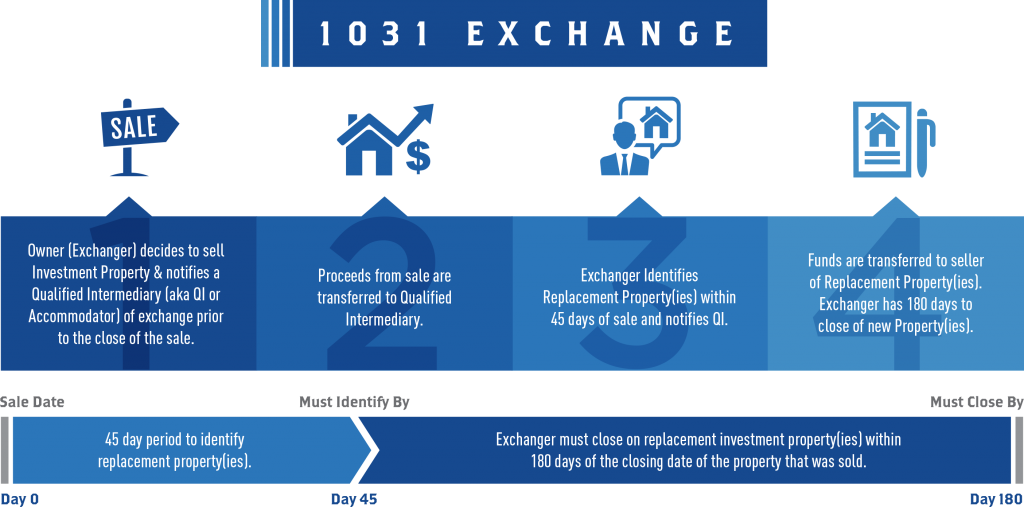

The benefit of utilizing this method is that, currently, you are not limited on the number of exchanges and can continue to “defer” the tax gain indefinitely. If you have properly set up a good estate plan, you and/or your estate could potentially use those funds to grow your investment and defer paying the taxes, indefinitely. Here’s a good graphic to give you an idea of the time frame requirements:

For more details (i.e., if you really can’t sleep at night, or are a nerd like me who is interested in this stuff) here is a great Forbes article that gives a good summary:

http://www.forbes.com/sites/robertwood/2014/03/10/7-key-rules-about-1031-exchanges-before-theyre-repealed/

Have questions? be sure to consult your attorney and tax advisor.

Disclaimer: neither Dominic Silvestri nor Dominic Silvestri PLLC are tax attorneys or tax advisors. You should not rely on an article, published as a blog, for your legal or tax advice. Nor does such an article on a blog constitute an attorney-client relationship.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.